How to Apply for Power Cash Rewards Visa Signature Credit Card

Anúncios

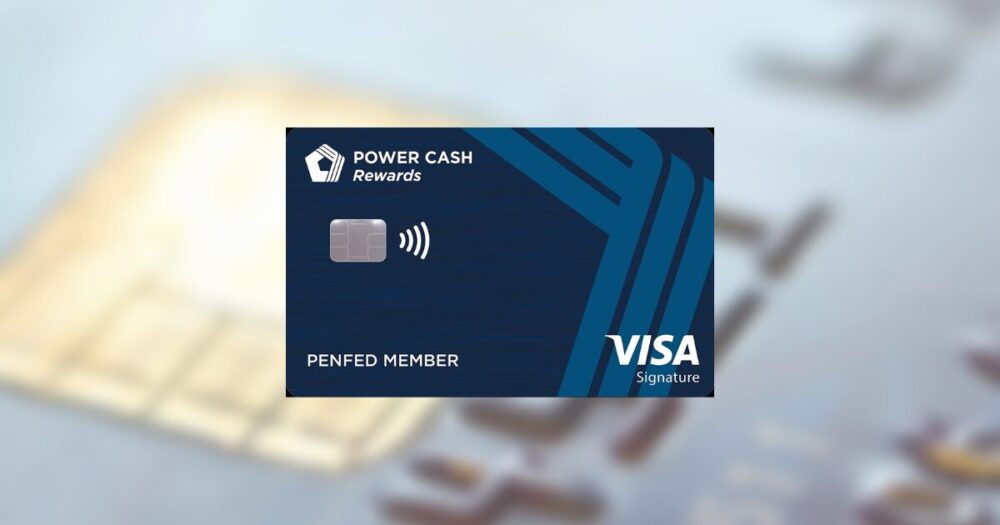

Looking to maximize your cash rewards with added perks? The Power Cash Rewards Visa Signature Credit Card offers enticing benefits that cater to savvy spenders. Unlimited 1.5% cashback on every purchase makes it an attractive choice for those who love to earn while they spend.

What sets this card apart is the special loyalty bonus. Members can earn a 2% cashback if they meet certain account qualifications, which means more savings every time you use it. Plus, cardholders enjoy premium Visa Signature benefits like travel and purchase protection, adding an extra layer of confidence to your financial adventures.

Anúncios

Not only does this card deliver financial rewards, but it also integrates seamlessly with modern life conveniences, boasting a user-friendly mobile app and contactless payment options. With its competitive features, this card may well be worth considering for your daily financial needs.

Unveiling the Benefits of the Power Cash Rewards Visa Signature Credit Card

Unlimited Cash Back on Every Purchase

The Power Cash Rewards Visa Signature Credit Card offers an impressive 1.5% unlimited cash back on all your purchases. This straightforward cash back program means you don’t have to keep track of spending categories or rotate quarterly bonuses. Every swipe brings rewards, making it an ideal option for those who prefer simplicity. To maximize this benefit, use your card consistently for daily expenses such as groceries, gas, and online shopping. Your transparent rewards structure ensures predictable returns each month.

Anúncios

Digital Wallet Compatibility

In our fast-paced digital world, convenience is key. The Power Cash Rewards Visa Signature Credit Card can be added to mobile payment systems like Apple Pay, Google Pay, and Samsung Pay. This allows for easy and secure payments without having to carry your physical card. Make sure to add your card to these digital wallets and experience the seamlessness of contactless payments!

Exceptional Security Features

In an era where digital threats loom large, security is paramount. This credit card comes equipped with robust security features, including zero liability protection against unauthorized transactions. The card’s built-in fraud monitoring system alerts you of any suspicious activity, providing peace of mind while you shop. To further enhance security, always monitor your transactions regularly and report any discrepancies promptly.

Introductory APR Offers

The Power Cash Rewards card sweetens the deal with a 0% introductory APR on balance transfers for the first 12 months. This offer could be particularly advantageous if you are looking to consolidate debt or make a large purchase without the immediate burden of interest. Plan your balance transfers carefully within this period to maximize potential savings, while paying attention to any transfer fees that may apply.

GET YOUR POWER CASH REWARDS VISA SIGNATURE CREDIT CARD THROUGH THE WEBSITE

| Category | Features |

|---|---|

| Cash Back Rewards | Earn 1.5% unlimited cash back on all purchases, enhancing your everyday spending. |

| Introductory Bonus | Receive a generous bonus cash offer if you spend a certain amount in the first few months. |

| Category | Benefits |

|---|---|

| No Annual Fee | Enjoy the card without worrying about annual fees, maximizing your savings. |

| Flexible Redemption Options | Redeem cash back for statement credits, gift cards, or travel, offering versatility to suit your needs. |

Requirements to Apply for Power Cash Rewards Visa Signature Credit Card

- Credit Score: Applicants typically need a good to excellent credit score, generally starting at 700 or higher, to qualify.

- Minimum Income: Proof of a stable income is essential, though the card issuer does not specify an exact minimum. Demonstrating the ability to manage repayments is critical.

- Citizenship: U.S. citizenship or permanent residency may be required, ensuring compliance with national financial regulations.

- Membership: Applicants must join PenFed Credit Union, as this card is a member-exclusive benefit. However, becoming a member is a straightforward process.

- Age: Applicants should be at least 18 years old, aligning with legal financial activity requirements in the United States.

LEARN MORE DETAILS ABOUT POWER CASH REWARDS VISA SIGNATURE CREDIT CARD

How to Apply for the Power Cash Rewards Visa Signature Credit Card

Step 1: Access the PenFed Website

To begin your journey to cash rewards, start by accessing the PenFed Credit Union’s official website. Once there, navigate to the credit cards section. The Power Cash Rewards Visa Signature Credit Card is designed for those seeking value-added rewards in their everyday purchases. Take a moment to peruse the features of this card – you might find its cashback offers intriguing!

Step 2: Review Eligibility Requirements

Before diving into the application, ensure that you meet the eligibility criteria. Typically, an excellent credit score enhances your chances, but PenFed Credit Union aims to accommodate a broad spectrum of applicants. Understanding the prerequisites at this stage is crucial to avoid any future surprises.

Step 3: Complete the Online Application

Once you are confident about the eligibility, proceed to the application page. Fill out the required details carefully; accurate information is paramount. The application form will require your personal, employment, and financial details. Pay attention to each field as you make this crucial entry into the world of cash rewards.

Step 4: Submit Your Application

With the application form filled, your next step is to submit it for review. This process, usually seamless and fast, may take a few minutes. Submission marks the beginning of your assessment phase, where the bank evaluates your information to make an informed decision on your application.

Step 5: Await Application Decision

After submission, all that remains is patience. PenFed typically communicates their decision swiftly, often within a few business days. Keep an eye on your email for any updates. Once approved, you can expect your new card soon, ready to redefine your purchasing power with enticing cash rewards.

VISIT THE WEBSITE TO LEARN MORE

Frequently Asked Questions about the Power Cash Rewards Visa Signature Credit Card

What are the key benefits of the Power Cash Rewards Visa Signature Credit Card?

The Power Cash Rewards Visa Signature Credit Card offers several compelling benefits. It provides unlimited 1.5% cash back on every purchase, which is quite competitive in the credit card market. Additionally, cardholders may earn up to 2% cash back if they qualify as Veterans Advantage members. Another noteworthy advantage is the absence of an annual fee, making it an attractive option for those seeking a cost-effective rewards card.

Is there an introductory APR offer with this credit card?

Yes, this credit card currently features an enticing introductory offer. New cardholders can take advantage of a 0% Introductory APR on purchases and balance transfers for the first 12 months, providing a breathing space for consolidating debt or making large purchases with no initial interest charges. After the introductory period, a variable APR based on the Prime Rate will apply.

What credit score do I need to apply for this card?

The Power Cash Rewards Visa Signature Credit Card generally requires a good to excellent credit score for approval. This means that applicants should ideally have a credit score of 700 or higher. However, other factors are also considered during the application process, so it might be worthwhile to explore your options even if you’re on the lower end of this range.

Are there any additional fees associated with this card?

One of the appealing aspects of the Power Cash Rewards Visa Signature Credit Card is its lack of an annual fee. However, it’s important to note that there are fees for other services, such as a balance transfer fee of 3% of the transaction amount with a minimum of $5 and a foreign transaction fee of 1% on purchases made abroad. Be sure to review the card’s terms and conditions thoroughly to understand all potential fees.

How can I redeem the cash back earned with this credit card?

Redeeming your cash back earnings is straightforward with the Power Cash Rewards Visa Signature Credit Card. Cardholders can easily redeem cash back as a statement credit or into an eligible account. The flexibility of the redemption options allows you to manage your rewards in a way that best suits your financial needs.

Related posts:

How to Apply for US Bank Cash Visa Signature Credit Card

How to Apply for Bank of America Premium Rewards Elite Credit Card

How to Apply for Bank of America Premium Rewards Credit Card Easily

How to Apply for a Wells Fargo Personal Loan Step-by-Step Guide

How to Apply for Preferred Cash Rewards Visa Signature Credit Card

How to avoid hidden fees when using a credit card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.